Macro Economics Principle

Arranged by :

Resha Ariella

1610631030230

1 - AKT - A8

Faculty of Economy and Bussiness

University of Singaperbangsa Karawang

Foreword

First, Praise God Almighty for all the blessings so that this task can

be completed. Don't forget i would like to thank Mr. Irvan Yoga

Pardistya, SE., MM., Ak.

Hopefully this task can increase knowledge and provide benefits to the

readers. Due to lack of knowledge and I am still in the learning

process, I believe this task is flawed, therefore I hope any

recommendation or criticisms from the readers to make this task better.

Karawang, 10th October 2016

Resha Ariella

Consumption in the economic sense is all the use of goods and services that humans do to fulfill their needs. Consumption expenditure consists of government consumption and household consumption. Of the total of aggregated expenditure components of an economy, private household spending is the largest aggregate expenditure. Government expenditures are used for regional autonomy subsidies, food subsidies, salaries, repair of public facilities, and repayments of debt.

1. Economic Factors

There are four economic factors that determine the level consumption, that is:

a. Household Income

Household income is very large impact on the level consumption. Usually the higher the income, the level of consumption will also increase. Why is that? Because the income level increases, the ability of households to purchase a variety of consumption needs also grow. Additionally, high-income lifestyle will increasingly consumerist society.

b. Household Wealth

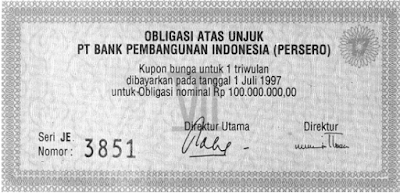

Which are included in household wealth is the real wealth and financial wealth. Real property, such as houses, cars, and land. While financial wealth is the letter of the securities, stocks and deposits. Riches can increase consumption, because it adds revenue. Deposit interest received each month and the dividend every year will increase household income.

c. Interest Rate

The high interest rates can reduce the consumption desires. With high interest rates, consumption activities are becoming increasingly expensive. Especially for them who want to eat with a credit system, for example by bank borrowing or using credit cards. The interest cost for loans which leads to high consumption costs anyway if the house, land and is leased cars owned. The income into non-wage income. The additional income will be used as consumption. Obviously this will increase consumption expendituremore expensive. They had better delaying or reduce consumption. Additionally, high interest rates cause people feel more profitable to save their money in banks rather than spent on consumption. Because some of the money saved in the bank, the money available for consumption is reduced.

d. Household Expectation About the Future

If the household is the better predict their future they will feel free to consume. Because of that consumption tends to increase. But otherwise, if estimates of future conditions worse, they square off to pressing the consumption spending. The internal factors to estimate future prospects of the household among others whether the father or mother is still working Is the career and salary increases? Or is there any other family members who would work? While external factors that affect future estimates include the condition of the domestic economy and the economic policy conducted by the government.

2. Demografi Factors

Demographic factors include the amount and population composition :

A. Amount of Population

The big amount of population will increase the overall of consumption expenditure.even though the average expenditure a person or a family is relatively low. For example although the level of consumption the average population of Indonesia is lower than the population of Singapore, but the level of consumption expenditures Indonesia is still bigger than Singapore. This is because Indonesia's population is bigger than Singapore, almost fifty-one times over. Then the level of household consumption Indonesia is very large. Consumption expenditure of a country will be very large if the amount of the inhabitants and per capita income is very high. An example happens to the United States and Japan. The state consumption spending dozens of times greater than Indonesia. Even though a population almost equal to Indonesia but the a capita income of the United States is much larger.

B. Population Composition

The composition of the population could be seen from several classifications including age, gender, education and living area. Effect of the population composition of the level of consumption can be explained as follows:

1. The more people of working age, or productive age will be effect on the level of consumption will be greater. It happens if it is supported by high job opportunities and good wages. The more people are working, people's incomes will also increase.

2. The higher the level of public education, so the level of consumption will be higher. when somebody is erudite, the necessities of life will be more larger. Highly educated people not only fulfill their needs, but also the need for the association and information.

3. The more people living in urban areas, consumption expenditure also higher. the pattern of urban living more consumptive than rural people.

3. social-cultural factors :

Socio-cultural factors were also effect on the level of consumption in society. For example the pattern eating habits, changes in ethics and values. Real example is changing the shopping habits of traditional markets to supermarkets causing increased consumption for shopping atmosphere that is more practical and comfortable. In reality it is difficult to sort out what factors most affect the occurrence of the change in consumption. For the above three factors are interrelated. It could be in the low-income groups turned out to very high consumption due to the influence of the rich life they watch on television.

According to keynes, consumption expenditure is doing by the household sector in the economics, depends on the amount of income.The comparison between the amount of consumption by the number of revenue-called tend consume(MPC = marginal propensity to Consume). More lager the MPC,more bigger too for the income used for consumption and vice versa.

Saving

Saving is a part of income of a person, a company or institution that is not spent or incurred for current consumption. Savings are usually stored in the form of deposits in banks, financial institutions, etc., or used to acquire financial assets such as stocks, bonds, and others. By deferring expenditures for consumption, savers can improve their future income through dividends or interest. In a macro-economic analysis, savings are part of the national income that is not used for current consumption. Savings are very important in finance physical investment Saving money means saving resources that can be used to increase the company's capital, which will increase its capacity to produce more goods. Savings derived from several sources as follows:

1. Government's saving

Government savings almost entirely from the excess of government revenue. overall on government consumption expenditure.several studies have shown that the government saving is not too big. There are only a few cases in which the government savings mainly from the State Owned Enterprises (BUMN), which contributes greatly to the overall government savings. In general, the role of government savings are very small indeed. The most often used to mobilize savings the government is through increased tax collection ratio to GNP, reform of the tax structure, and if possible through increase in the tax rate that has been there. Stopping foreign debt with the Government Savings Already, the government should reduce the foreign debt because it is time to think about self-reliance. In a sense we should be able to use the funds in the community rather than having owe. It's just that there are two problems, that is where domestic funds and how that domestic funds can not replace foreign funding.

2. Domestic private savings

In many countries, private savings given a big effect for supporting capital formation. The collection of domestic private savings work well if the community managed to reduce the level of consumption. Private savings consists of two components, there are : household savings and corporate savings.

A. Household savings

Household savings includes savings that come from wages, the result of personal efforts, partnerships and other forms of noncorporate businesses. The household saving will be very low if the level of income but stay high a tendency to consume. At least the community-owned savings due to the high level of household spending on consumption needs of primary school fees of children, and needs.

B. Company savings

Company savings are retained earnings after net profit company minus dividend, that paid for stock own. if in one country, much companies in smaller scale, then savings rate relatively low. a small company also have a problem insert a lot of savings. moreover, companies difficult to saving because the high amount of debt. foreign loan is difference of cost to building, reduced from government savings. because government savings is not enough, the companies must to borrow into foreign savings. so for small foreign savings, government savings must much more than foreign savings. The way with the efficiency of expenditures. Government savings is revenue government minus expenditures regularly, then both are well managed. Expenditure should be efficient, while revenues should be used. Because all this time, all countries revenue resources untapped well of. An example is the taxpayers who do not pay taxes.

With the large amount of funds receipts and expenditure efficiency routine will not strengthen the government loans. If the savings the government is still less, a new look for foreign loans. It is however not a single country in the world which can be separated from the loan, let alone that they build. Only the composition that needs to be regulated.

C. Foreign savings

Foreign savings consist of government foreign savings or foreign aid and Foreign private savings consists of mainly foreign investment by multinational corporations and external commercial borrowing. The components of these savings is important to know the capital outflow or investment illustrates the savings. The amount of savings available in some countries is simply the the amount government savings, domestic savings and foreign savings.

function of saving

On the savings function (saving) is the term MPS = marginal propensity to Saving a comparison of changes in disposable income by the change in the amount of savings.

While Average propensity to Consume APS is a comparison between the level of savings to income level.

Savings function is all the revenue after deducted by consumption. On the wider economy deduction more revenue, such as taxes and others. Saving function mathematically formulated as follows:

S = Yd - C

where :

S = the level of aggregate savings

Yd = the level of revenue

C = the level of consumption

Investment

The factors which influence investment aggregate is :

1. Effect of Exchange RateChanges in the exchange rate with the investment is uncertainty (uncertain). Shikawa (1994), said that the effect of exchange rate change on investment can be direct through multiple channels, exchange rate changes will affect the two channels, the demand side and the supply side of domestic. so we get the fact the exchange rate of the domestic currency will encourage the expansion of investment in items such trade.

2. Effect of Interest RateThe interest rate has a significant effect on the urge to invest. In the production, the processing of capital goods or raw material production requires capital (inputs) to produce another output / final goods.

3. InflationThe inflation rate have negative effect on the level of investment it is due to the high inflation rate will increase the risk of investment projects and long-term high inflation can reduce the average time fell to borrow capital and lead to distortion of information about relative prices. According to Greene and Pillanueva, the high inflation rate is often expressed as the size of the wheels macroeconomic instability and an inability of the government to control the macro-economic policy. Thus the domestic inflation rate also affect investment indirectly through its effect on domestic interest rates.

4. Infrastructure

Many countries in the world, invites investors to participate in investing in the infrastructure sectors, such as toll roads, electric energy sources, water resources, ports, and others. Such participation may be financing denominated in rupiah or foreign currency. Rebuilding infrastructure appears to be an alternative option that can be taken by the government in order to tackle the crisis, with adequate infrastructure, the efficiency achieved by the business world is even greater and increasing investment obtained.

5. The Government

Government spending here including all purchases of goods and services by local governments. Government as one economic actor that has the purpose to support the economy in order to run better and excited. The role of government as proposed by Keynes is often necessary to encourage economic growth.

Demand for investment is a function of the interest rate. If the investment is symbolized by the letter I and the interest rate is denoted with the letter i, then the general function of investment demand can be written:

I = Interest rate

Io = autonomous investment

p(i) = proportion I to i

Demand for investment inversely with interest rates. With the economic logic it is very easy to understand. If the interest rate is high, people will prefer to save their money in banks rather than invest it, because the results (expected return) will be obtained from bank interest is greater than the turnout expected to be received from the investment, resulting in reduced investment demand. Higher rates also reflects the high cost of credit, thus reducing the investment interest among entrepreneurs. The opposite happens if interest rates are low.

Tax is Mandatory contributions to the state owed by private persons or entities that are enforceable under law, by not getting the rewards directly and used for the purposes of countries for the overall prosperity of people.

Taxpayer (WP) is an individual or entity according to the provisions of the tax legislation is determined to do tax obligations, including tax collector or cutting certain taxes.

Taxable Entrepreneurs are entrepreneurs who do Taxable Goods and or rendering of taxable services are taxed based on the Law of Value Added Tax in 1984 and its amendments, excluding small-scale businesses which limits stipulated by the Decree of the Minister of Finance, except for small-scale businesses who choose to be confirmed the Taxable Entrepreneur.

Taxpayer Identification Number (NPWP) is the number given to the taxpayer as a means of tax administration that is used as personal identification or identity of taxpayers to exercise the rights and obligation.

NPWP funtion is : facilities in the tax administration, personal identification or identity of taxpayers to exercise the rights and obligation, maintaining order in the payment of taxes and in the supervision of the tax administration.

A.Budget function (Budgetair): Budgetair function referred to as the primary function of tax or fiscal functions (fiscal function), that is a function where the tax is used as a tool for optimally inserting funds to the state treasury by the tax laws and regulations. This function is called the main function for this function which historically was first raised. Here the tax is the largest source of financing the countries.

B. As a Management Tool (regulerend): This function has the sense that the tax can be used as an instrument to achieve certain goals. For example, when the government intends to protect the interests of farmers in the country, the government may set additional taxes, such as import taxes or import duties, on imports of certain commodities. C. As a Tool Guard Stability: The government could use taxation facilities for economic stabilization. Most of the imported goods to be taxed domestic products can compete. To maintain the stability of the exchange rate and keep the trade deficit does not widen, the government can set policies against the imposition of sales tax on luxury imports of certain products that are luxurious. Efforts are made to curb the import of luxury goods that contribute to trade deficit. - D. Income Redistribution Function: The government needs funds to finance the construction of infrastructure, such as highways and bridges. The need for the funds that can be met through the tax charged only to those who can afford to pay taxes. However, the infrastructure which was built earlier, can also be used by those who can not afford to pay the taxes.

Tax type manifold. This will vary depending on which side we see it. Tax sharing can be seen from who pays taxes, the agency picked up, and nature.

A. Types of Taxes by Person bore the

Based on the parties to bear, differentiated taxes on direct and indirect taxes.

- Direct Taxes (Direct Tax): direct tax is a tax levied on a regular basis against a person or entity based on tax assessments. Direct taxes borne by the taxpayer. Examples of direct tax are the income tax and property tax

- Indirect Taxes (Indirect Tax): Indirect taxes are imposed on the act or event. Taxation was levied without tax determination letter and can be transferred to another party. Examples of indirect tax is value-added tax, sales tax, and excise. In the value-added tax, sales tax and excise duty, the levy is firm and the bear is the consumer.

B. Types of Tax collector Based Organization

Meanwhile, based on the institution collector, tax on tax differentiated countries (central government) and local taxes (local government).

- State Tax: A tax is a countries tax levied implemented by the central government. Taxes including state taxes are income tax, value added tax on the goods and services sales tax on luxury goods.

- Local Taxes: Local tax is a tax levied by local governments, either by the county level I and level II by the local government. Local taxes are used by local governments to finance household. Examples of local taxes include taxes slaughterhouses, radio tax, advertisement tax, vehicle tax, motor tax and entertainment tax.

C. Types of Taxes Based on In character

By its nature, the tax on a tax distinguished subjective and objective tax.

- Subjective Taxes: subjective Taxes are taxes that stem from the subject (the taxpayer). For example, income tax and property tax.

- Taxes Objective: objective tax is a tax levied by the object regardless of the taxpayer. Examples of sales and excise taxes.

Tax benefits for the State Economy

- Expenditure State finance. Taxes have benefits degan finance state expenditures which are self liquiditing, for example, spending on productive projects export goods.

- Expenditure Productive finance. Taxes can finance productive expenditure where productive expenditure is expenditure that provide economic benefits to the community such as spending on irrigation and agriculture.

- Finance expenditures that are self liquiditing and unproductive example is the expenditure for the establishment of monuments and recreational objects.

- Finance unproductive expenses which for example is spending to finance the country's defense or war and expenditure savings in the futurethat is the expenditure for orphans.

Refrence

Trentmann, Frank. 2012.The oxford Handbook of the History of consumption. University oxford : OUP Oxford

Richard J. Joseph,The origins of the American Income Tax: the revenue Act of 1894 and its Aftermath 30-33(2004).

John B.Shoven and B.Douglas Bernheim.2009.National Saving and Economic Perfomance. University of Chicago Press.