Bank and Financial Institutions

Arranged by :

Resha Ariella

1610631030230

2 - AKT - 8

Faculty of Economy and Business

University of Singaperbangsa Karawang

2017

The Types of Money in Indonesia

There are two types of money in Indonesia, first is Real money and second is

A. Real Money

Real money is the money received by the public as a payment tool valid (protected by the Act) that are used daily and published by Bank Indonesia and printed by Perum Peruri (Money Printing Public Company of the Republic of Indonesia).

Real money consists of two kinds, that is :

1. Coins

The coins are money made from a specific metal such as gold, silver, copper, bronze or aluminum that be identified as / stamp as legal payment tool.

The example of coins that exists in Indonesia :

2. Paper Money

Paper money often called fiduciary money (money

trust). Peoples accepting the money for their confidence in the government that

issued that money, even if the intrinsic value is very small compared to the

nominal value.

Several advantages from exchange tools (money) if using paper are:

- Saving to using precious metals

- The cost of manufacture is relatively cheap compared to the cost of making money with metals.

- Circulation of paper money is elastic (Because of easily printed and reproduced) so easy to be adapted to money needs.

The examples of Paper money in Indonesia :

But, at the beginning of 2017 there is a change of money design. and the newest design like this :

B. Deposits Money

Deposits Money is money issued by commercial banks in the form of securities and any time can be used as means of payment.

These are examples of deposits :

1. Credit Card

Card that issued by Commercial Bank which is guarantee the holder to be able to shopping without paying and will be deducted directly from his savings account.

2. Check

That is written instructions from the account holder to the designated bank to pay an amount of money.

3. Bilyet and Giro

Bilyet and Giro is the warrant from the customer to the bank who maintain the current account customers, to transfer a sum of money from the account in question to the named recipient or account number in the same bank or another bank.

4. Stocks

Stocks is the books or unit of value in a variety of financial instruments which have a reference to part ownership of a company. Issuing stock, allowing companies who need long-term funding to 'sell' business interests in stock in exchange for cash. This is the main method to increase the business capital in addition to issuing bonds.

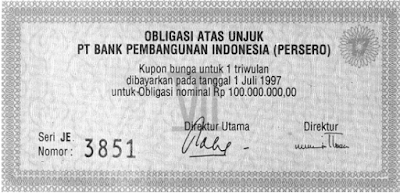

5. Bonds

Bond is a term used in the financial world which is a statement of the issuer's debt to the bondholders and a promise to repay the capital with interest at the time of the payment due date.

6. Wesel Post

Wesel, is a postal mail can be used to send money.

7. Insurance

Insurance is a system, or business where financial protection (or compensation financially) to life, property, health and so forth get a replacement of events that can not be predicted that can be happen such as death, loss, damage or illness, where the involves the payment of premiums on a regular basis within a specified period in exchange for a policy that guarantee such protection.

The advantages of using Deposits money :

- Make it easy for payments because they do not need to count the money

- Payment tool are acceptable for an unlimited amount.

- Safer because of the risk of money lost is smaller and if lost can be immediately reported to the bank that issued the check or giro by way of blocking.

- Practical and safe.

- Can be transferred without spending a lot of money.

Weakness of using Deposits money :

- Is not effectively used to pay in small amount.

- Not everyone can be accepted it.

Biblioghrapy

- Iswardono SP.1984.Uang dan Bank.Yogyakarta : BPPE

- Rahardja, Prathama.1988.Uang Dan Perbankan.Yogyakarta: Eonomic Student Group

- Drs.O.P.Simorangkir.2000.Pengantar Lembaga Keuangan Bank dan Nonbank. Jakarta: Ghalia Indonesia

- http://tu.laporanpenelitian.com/2014/11/24.html

- Google Pictures